Blog

Genealogy Tips: Find Ancestors in Tax Records

It’s time to pay taxes in the United States!  Is it any consolation that our ancestors paid them, too? Here’s a brief history of U.S. federal taxation and tips on where to find tax records for the U.S. and the U.K.

Is it any consolation that our ancestors paid them, too? Here’s a brief history of U.S. federal taxation and tips on where to find tax records for the U.S. and the U.K.

According to the National Archives (U.S.), the Civil War prompted the first national income tax, a flat 3% on incomes over $800. (See an image of the 16th Amendment and the first 1040 form here.) The Supreme Court halted a later attempt by Congress to levy another income tax, saying it was unconstitutional. In 1913 the 16th Amendment granted that power. Even then, only 1% of the population paid income taxes because most folks met the exemptions and deductions. Tax rates varied from 1% to 6%–wouldn’t we love to see those rates now!

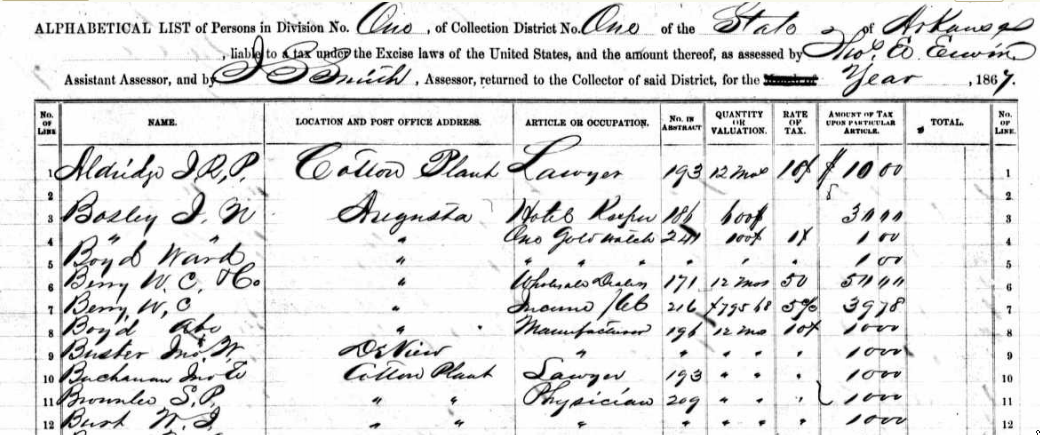

Ancestry.com has indexed images of U.S. federal tax assessment lists from the Civil War period (and beyond, for some territories). Here’s a sample image from Arkansas:

Of course, the U.S. federal income tax is just one type. Taxes have been levied on real estate, personal property and income by local, regional and national governments throughout the world.

Some tax records are online. Ancestry.com hosts tax records from London (1692-1932); the U.S. states of Pennsylvania, Tennessee, New York, Ohio, Georgia and Texas; and many from Scotland, Ireland, Canada and Russia (there’s more: see a full list and descriptions here). FamilySearch.org hosts over a million records each of U.S. state tax records from Ohio and Texas. FindMyPast hosts a wealth of U.K. tax records, from local rate books to Cheshire land taxes and even the Northamptonshire Hearth Tax of 1674.

In the U.S., look for original real estate and personal property taxpayer lists in county courthouses or state archives. Consult genealogical or historical organizations and guides. Or Google them! A Google search for “tax records genealogy Virginia” brings up great results from the Library of Virginia and Binns Genealogy. (Use the keyword “genealogy” so historical records will pop up. Without that term, you’re going to get results that talk about paying taxes today.)

I’ll leave you with this tantalizing list of data gathered in the Calhoun County, Georgia tax list of 1873: first, it enumerates whites, children, the blind/deaf/dumb, dentists, auctioneers, and those who have ten-pin alleys, pool tables and skating rinks. Then, real estate is assessed in detail. Finally, each person’s amount of money, investments, merchandise, household furniture, and investment in manufacturing is assessed.

As you can see, it can pay you big to invest time in looking for your ancestor’s tax records! Just make sure that if you’re here in the U.S., you’ve got your own taxes out of the way before you go searching for someone else’s.

Like this post? Look around on the Genealogy Gems website! We have lots more free content to offer, including our flagship Genealogy Gems podcast, an online radio show that brings you the best “gems” in genealogy how-tos, inspiration and fun. We have more than 1.5 million downloads worldwide: listen and you’ll see why!

Like this post? Look around on the Genealogy Gems website! We have lots more free content to offer, including our flagship Genealogy Gems podcast, an online radio show that brings you the best “gems” in genealogy how-tos, inspiration and fun. We have more than 1.5 million downloads worldwide: listen and you’ll see why!

What the U.S. Federal Government Could Learn from Genealogists

Beware: Personal Opinions are coming your way in this article!

In my book The Genealogist’s Google Toolbox I emphasize how to use Google to determine what is already available and free online before investing your limited time and money in offline family history searching. Smart genealogists allocate their resources wisely, getting the most bang for their buck. And collaboration between individual genealogists allows us to accomplish even more.

It looks like the U.S. Federal Government could learn a thing or two from savvy genealogists. The Washington Times is reporting that Congress’s auditor has discovered that our tax payer money given to the federal government isn’t being spent very wisely. (Imagine that!) Agencies fail to collaborate and share information, creating redundancy and overspending.

It looks like the U.S. Federal Government could learn a thing or two from savvy genealogists. The Washington Times is reporting that Congress’s auditor has discovered that our tax payer money given to the federal government isn’t being spent very wisely. (Imagine that!) Agencies fail to collaborate and share information, creating redundancy and overspending.

One example from the article: the Commerce Department “has been charging other government agencies millions of dollars for reports that the other agencies could just as easily have gotten online, for free – often with a Google search.”

This news makes it even harder to swallow the news that the National Archives and Records Administration (NARA) is suffering reduced hours of service due to budgetary issues.

The Bottom Line:

Google Twice, Pay Once (and only if you have to!)

Find Your Confederate Civil War Soldiers

For the month of April, Fold3 is offering free access to its Confederate Civil War collections of more than 19 million records. Many of these are from the National Archives’ War Department Collection of Confederate Records: Confederate Compiled Service Records, Confederate citizens’ files and Confederate Casualty Reports. Whether you’re looking for specific Confederate Civil War soldiers or you’re just interested in history, these records are fascinating!

For example, there are compiled service records for “Galvanized Yankees,” or Confederate prisoners-of-war who obtained a release by enlisting in the Union army. Many of these files have the soldier’s declaration of “Volunteer Enlistment” and an oath of allegiance to the United States. You have to wonder what each man was thinking and feeling as he signed these papers. How did his Union enlistment go? How did his family and community react? If he survived the war, how was his life afterward affected by that choice? There are stories behind every record–and Civil War records are some of the most compelling.

You’ll also find other interesting records in this collection, many created post-war: the Confederate Amnesty Papers, Confederate Navy Subject File, papers relating to the Civil War Subversion Investigations, and files of the Southern Claims Commission.